The banking industry is undergoing a fundamental transformation these days. As digitalization penetrates all industries and spheres, it impacts both the business landscape and customer expectations. The pace of digital transformation is even more rapid in the Gulf Cooperation Council (GCC) region, where it is a top priority supported by governments and investments.

Since customers expect seamless, quick, and intuitive experiences, banks face mounting pressure to deliver new features and services faster than ever. However, financial organizations (especially large and long-established banks) often struggle with multiple legacy systems that slow development cycles and impede agility.

Here, digital decoupling emerges as a game-changing solution, empowering banks to modernize their systems and drastically improve their time-to-market.

This article explores the basics of digital decoupling, its implementation, technical and business considerations, and the benefits financial organizations can avail of by choosing this approach.

What is digital decoupling?

The essence of digital decoupling lies in isolating critical functions from legacy systems, enabling them to operate independently. It is achieved by creating new microservice-based applications that address specific tasks without directly relying on or altering the underlying core systems.

In a bank’s IT infrastructure, these microservice applications form a logical layer between digital channels – such as mobile apps, websites, and customer care applications – and the legacy core systems, which are often provided by third-party vendors. Microservices act as intermediaries facilitating communication between modern digital platforms and older systems while ensuring minimal disruption to the core infrastructure.

Microservices excel at handling dynamic customer demands and rapidly evolving market requirements. By processing and fulfilling customer requests at the microservice layer, banks can avoid making time-consuming and costly modifications to their legacy core systems.

Digital decoupling enhances agility and responsiveness. It also reduces the risk associated with direct modifications to legacy systems, which can be prone to errors and downtime.

Digital decoupling step by step

The process of digital decoupling generally includes three key stages:

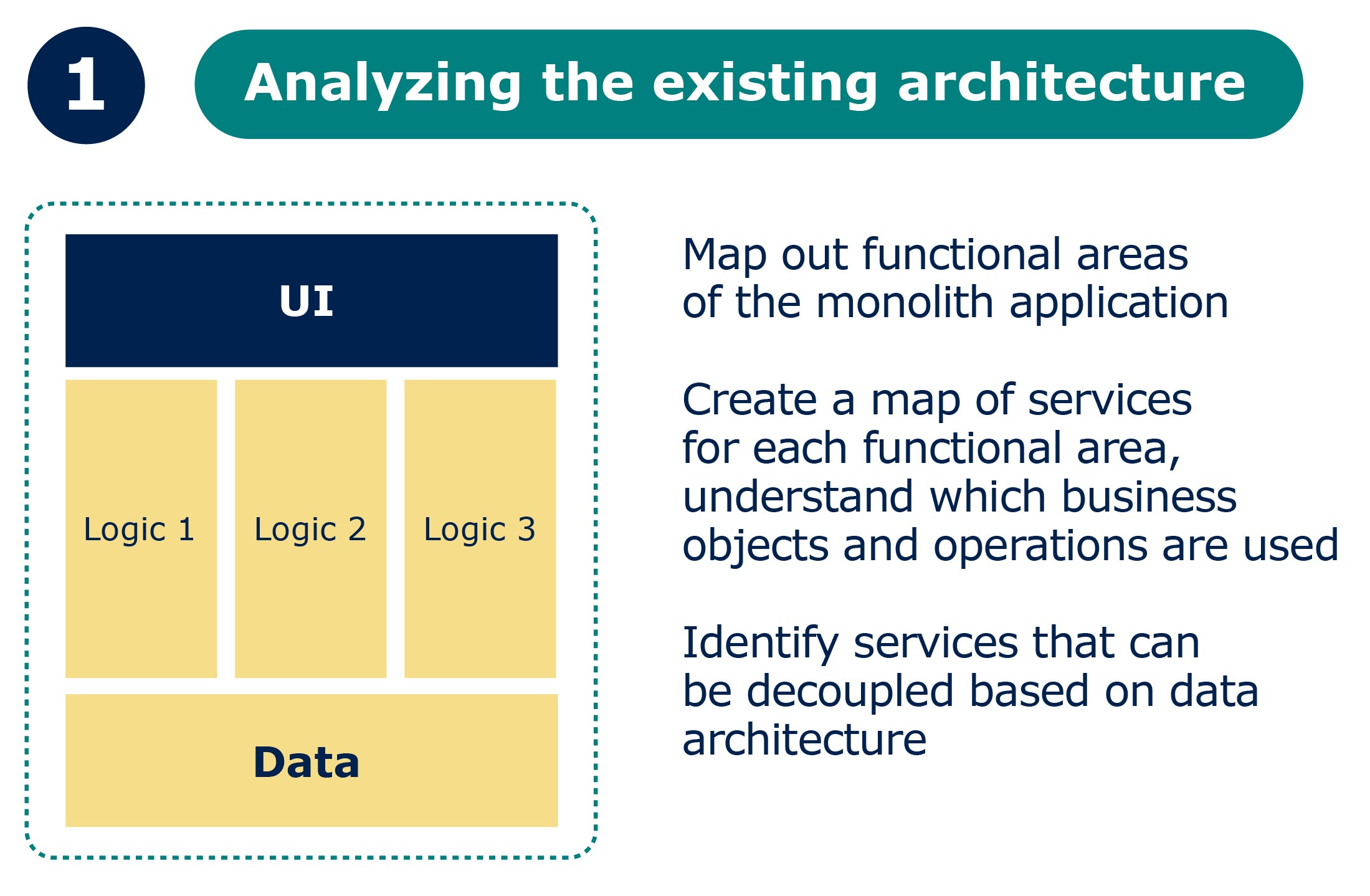

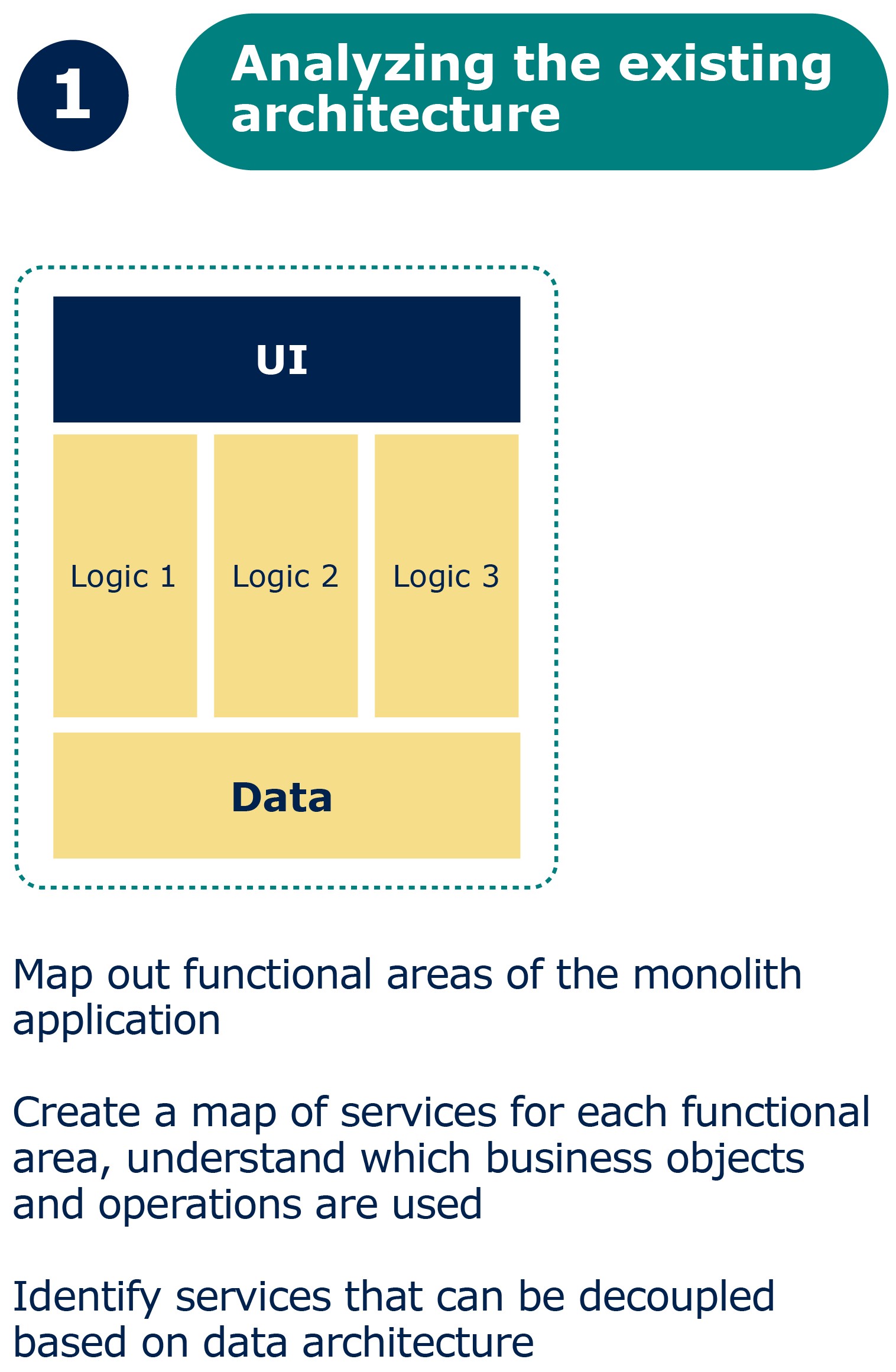

The journey begins with mapping out legacy applications, their functional areas, and related services. After that, services are analyzed based on their functionality and the data they handle, such as client profiles or accounts. Having achieved this full visibility of the infrastructure, banks identify which services to decouple.

Important note: When starting decoupling, it is critical to ensure data consistency between the legacy and decoupled systems.

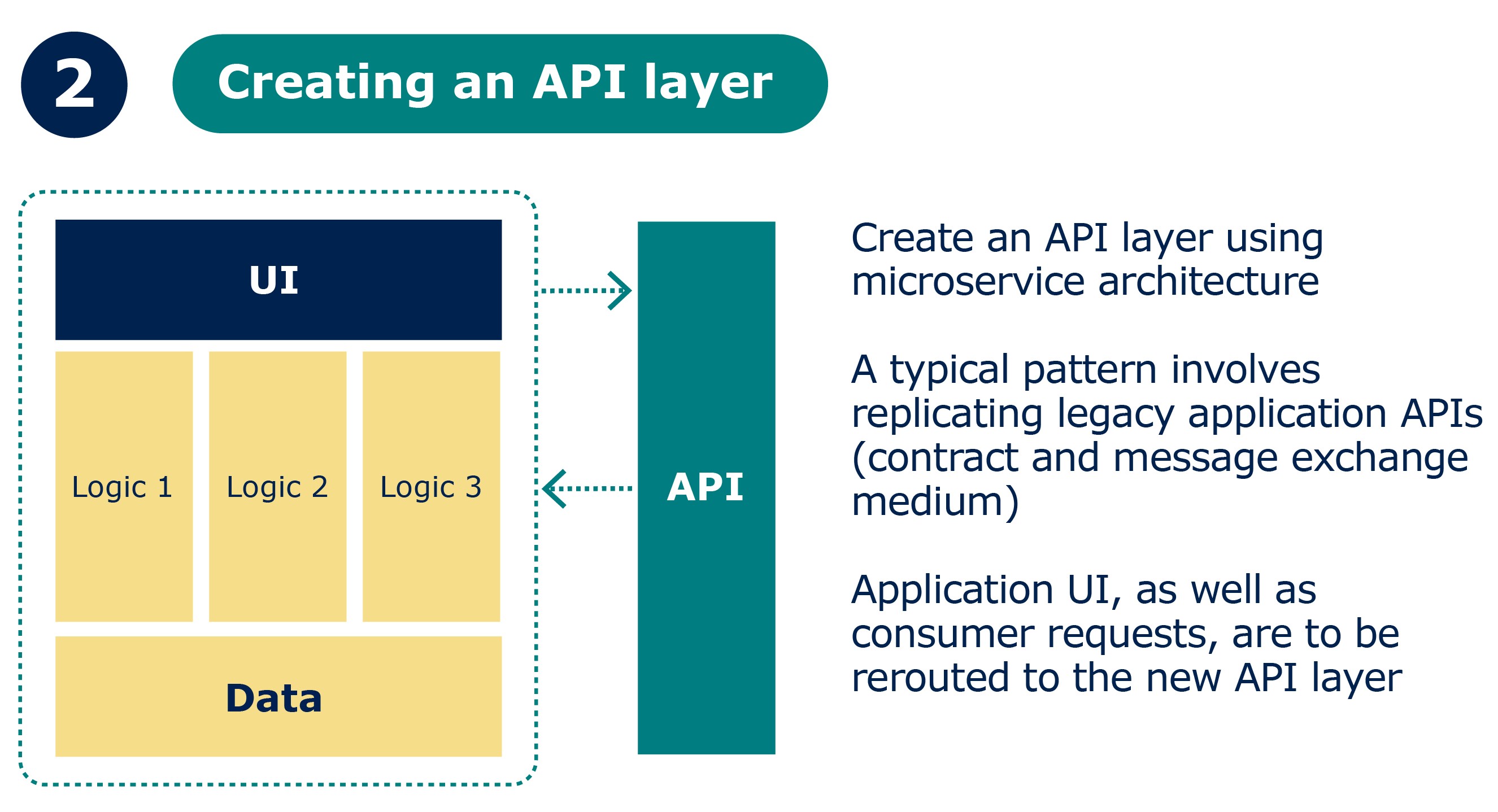

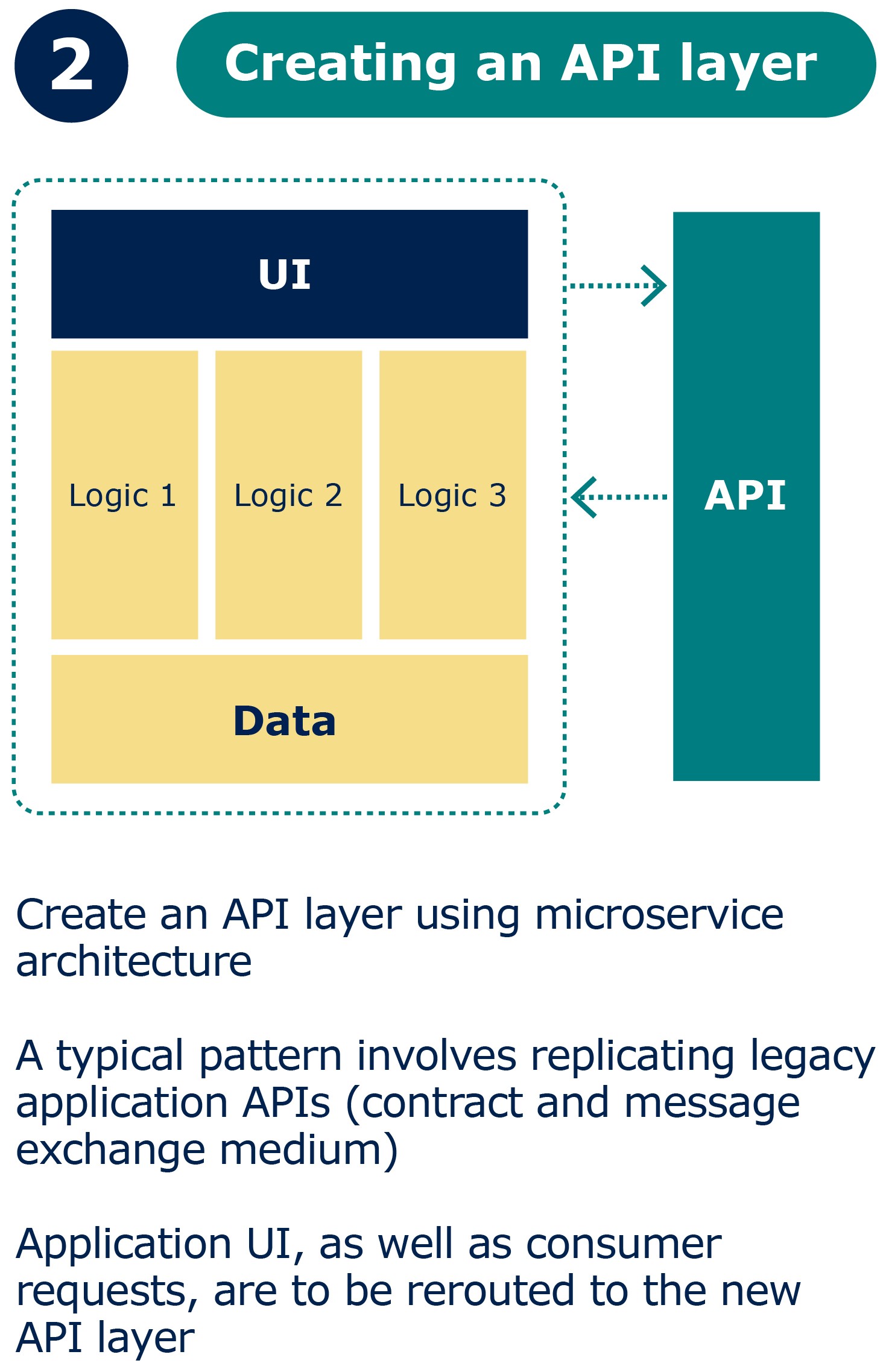

The next step involves implementing an API layer, which serves as the interface between customer-facing applications and core systems. By replicating legacy system APIs in the new layer, organizations can handle client requests more efficiently.

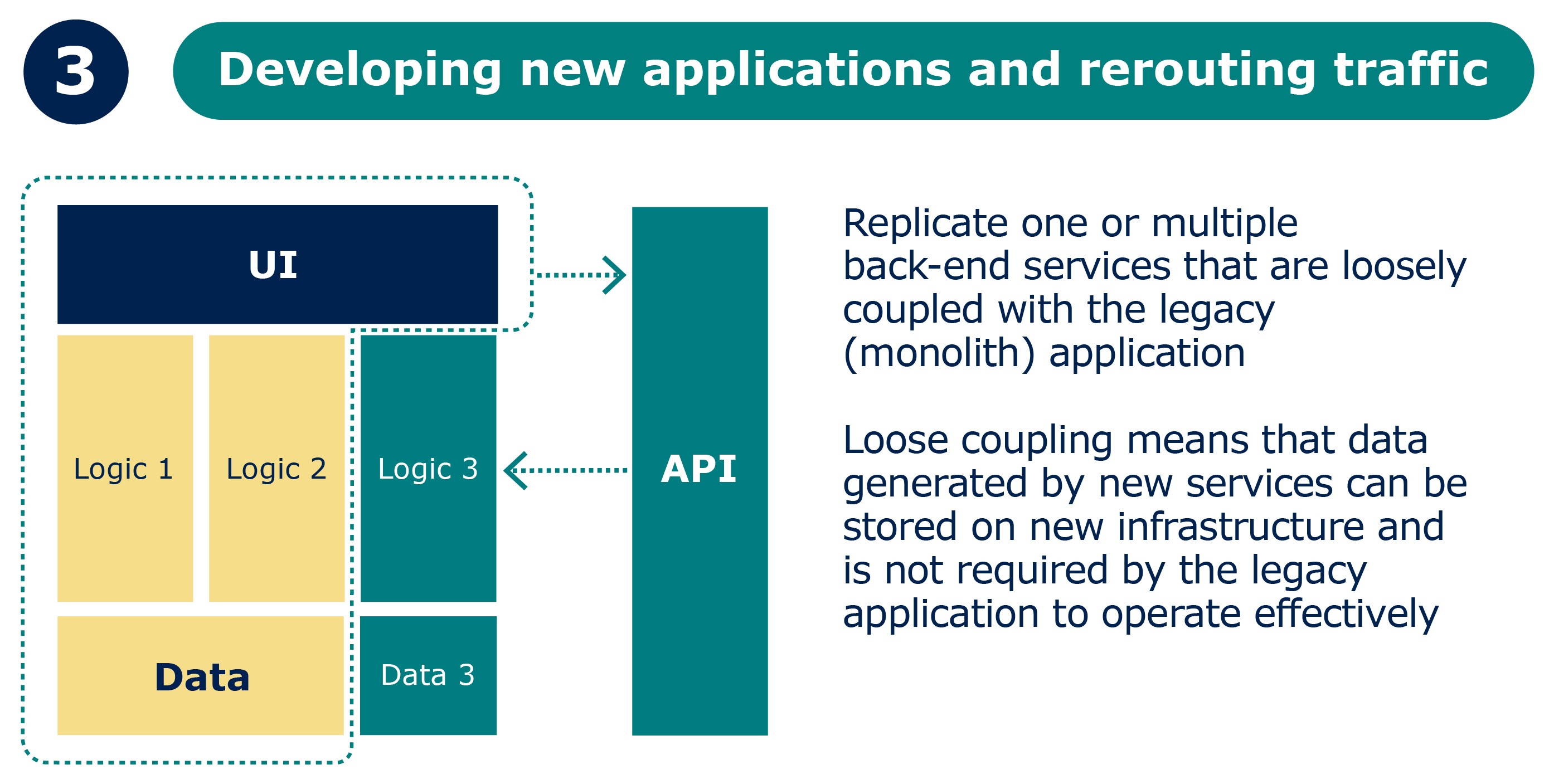

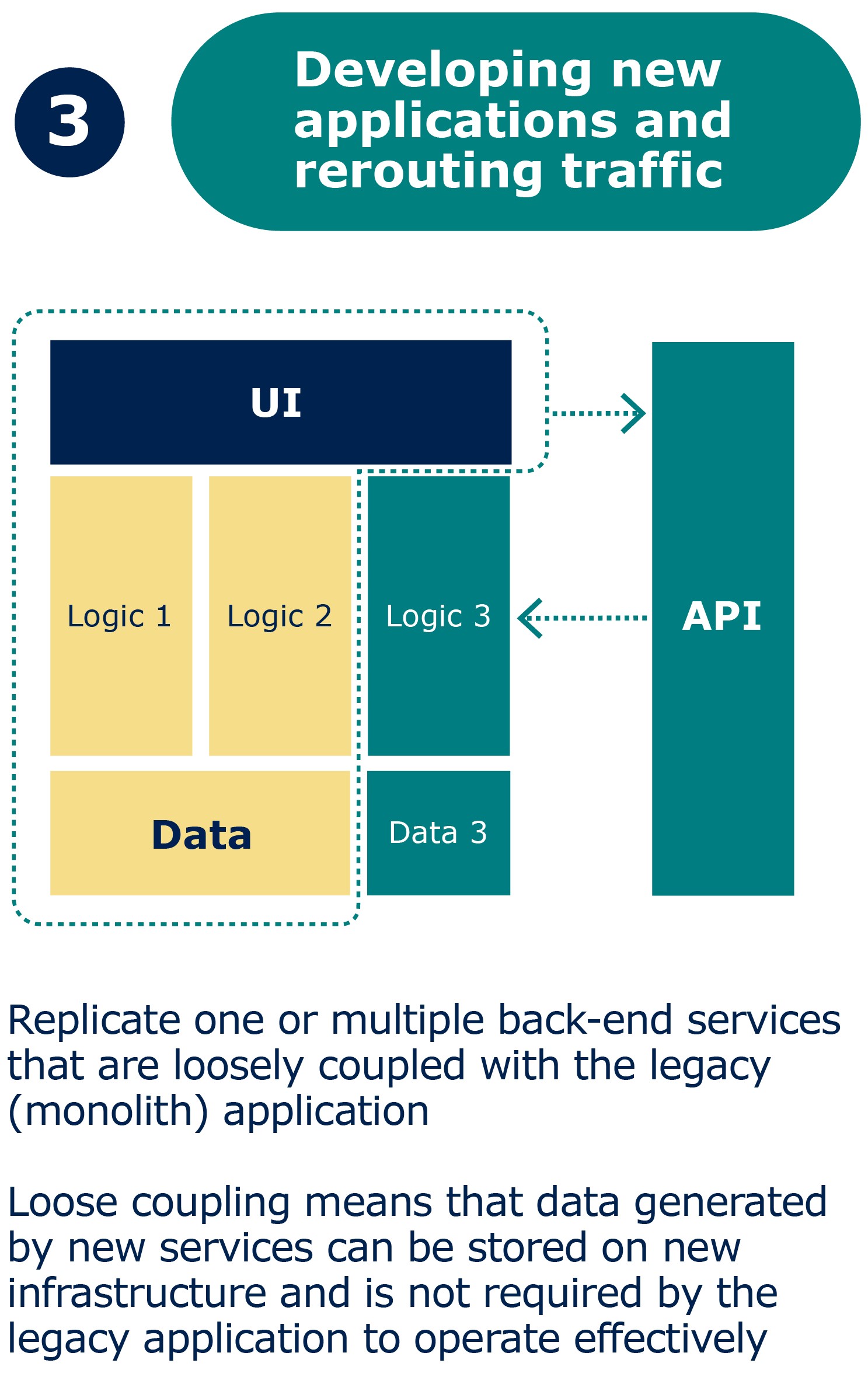

Once the API layer is operational, banks can deploy new back-end services and applications. The API layer will reroute all the requests related to new functionality to the newly created services instead of legacy systems.

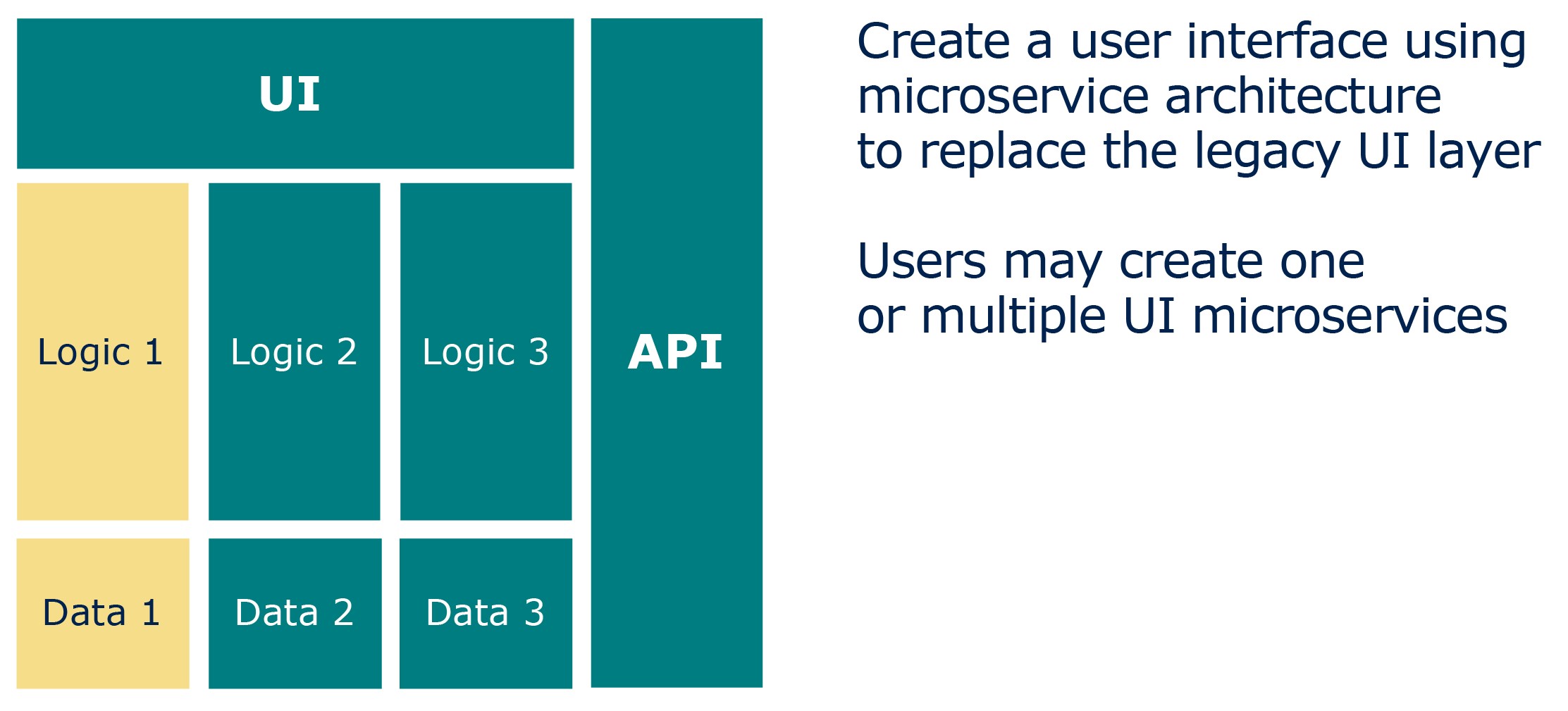

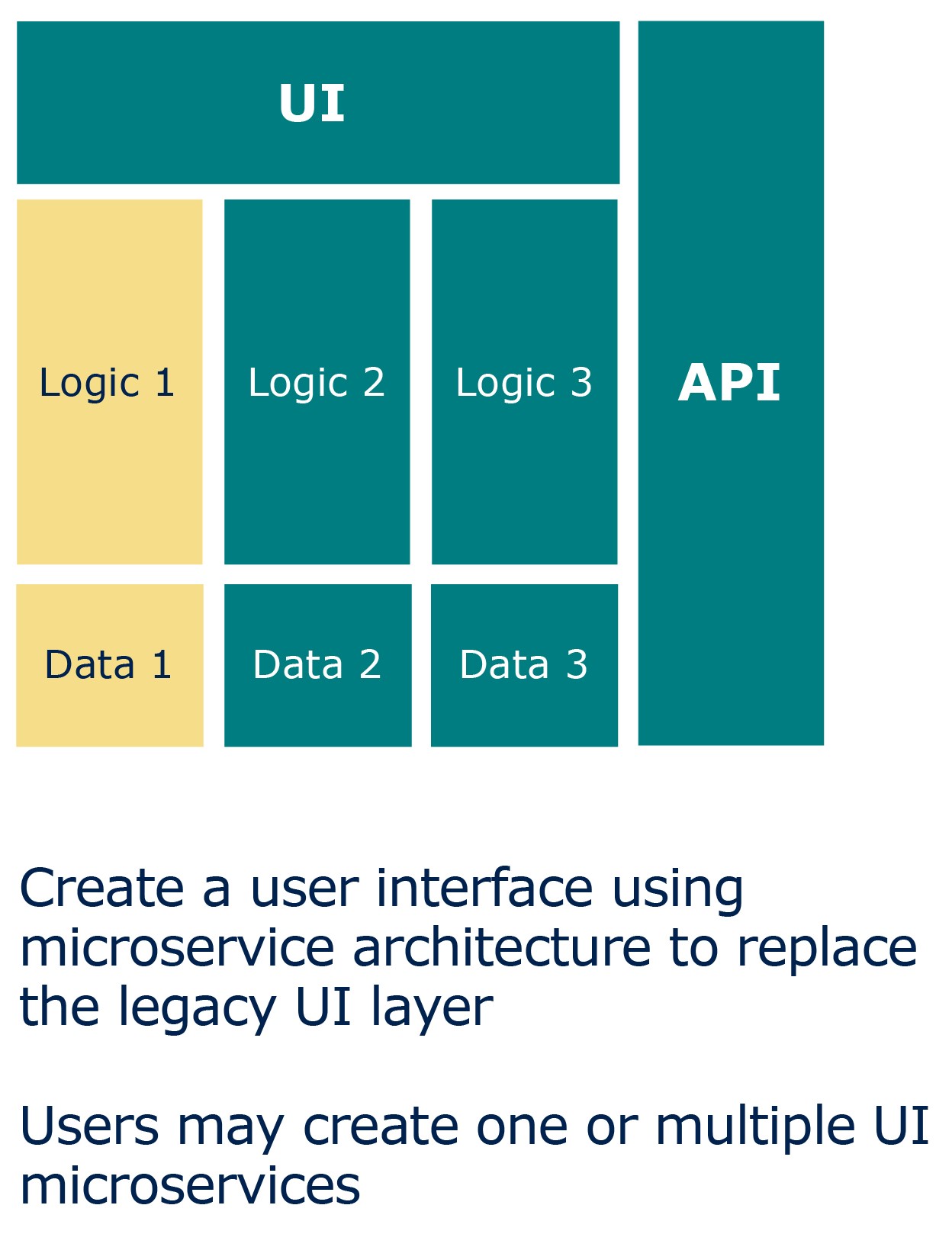

Meanwhile, the legacy applications continue to operate alongside new microservices, which can be further developed to transition functionality to a modern technological platform. This back-end transformation significantly enhances application performance while maintaining the familiar user experience of the legacy UI layer.

At this stage, individual components can be more easily evolved, and the underlying systems (including the user interface) can be gradually replaced to optimize costs, leverage cloud resources, and achieve other benefits, all without disrupting application operations.

Design considerations for implementing

In a decoupled microservice architecture, components that were once tightly integrated into a legacy application are restructured to function independently from the rest of the system. It means that each component now operates with its own data, logic, and lifecycle. This creates certain technological and design considerations.

Service organization

When creating new components in a decoupled architecture, organizations must address two critical questions: What should be migrated to the new microservice platform? and How should services be structured for optimal functionality and reusability?

To guide the service organization, companies may employ design patterns like domain‑driven design or composable architecture. As an example, services may be organized by:

- Business domains – Services are structured around specific business areas such as consumer lending, mortgage lending, or payments.

- Data-centric grouping – Services are grouped based on their role as the master source for specific data entities, e.g., retail clients, scanned documents, or electronic signatures.

Message exchange

New decoupled microservices are accessed through APIs using standardized message formats and transport protocols. To manage this communication efficiently, an API platform is often employed as an intermediary for message exchange, providing endpoints to consumers and routing messages to the appropriate providers. The platform also offers essential infrastructure and services, including (but not limited to):

- Authentication and authorization that ensure secure access to microservices;

- Message routing (API Gateway), which directs requests to the appropriate services;

- Service discovery to identify and connect to available services dynamically.

The benefits banks get from digital decoupling

To better understand the benefits that digital decoupling brings to business operations, let’s consider a model retail bank. Its IT architecture was likely developed in different periods, let’s say:

- Digital channels (web & mobile) were implemented in 2022–2024 and are microservice-based applications;

- Middle-office applications were implemented between 2010–2012;

- Back-office applications, including core banking and card processing systems, were also implemented between 2010–2012.

With such a legacy, banks generally face two major challenges:

- Slow time-to-market

The core banking system (CBS) currently represents a significant bottleneck in delivering new business functionality. Release cycles are delayed by up to three months, and the bank struggles to justify upgrades due to an unclear return on investment. - Fragmented IT landscape

The digital channels (web and mobile) offer inconsistent user experiences due to limitations imposed by service providers. Implementing changes requires coordination across multiple service-provider applications, adding complexity and delays.

From a business perspective, digital decoupling offers clear advantages. It allows the bank to improve time-to-market, enhance the user experience across all channels, and utilize IT resources more efficiently. Let’s take a closer look.

Faster time-to-market

Decoupled applications are built using a microservice architecture, which enables rapid (within weeks) development and deployment of changes to production. Problematic parts of an application can be isolated for fixes or updates, allowing the larger application to continue functioning without disruption.

Organizations that implement digital decoupling report significant improvements in time‑to‑market, often achieving 2-3x faster delivery compared to legacy or proprietary applications. This agility allows businesses to stay competitive and respond swiftly to market demands.

Reusability

One of the standout benefits of digital decoupling is the reusability of functionality provided by middle-office or back-office applications. These decoupled services can be shared across banking products for various client segments, including retail, SMEs, large corporations, and ecosystem partners.

For example, authentication and authorization services are required across all applications, and a single microservice can fulfill this need. Similarly, a notification service used for internet banking can handle alerts like SMS, email, push notifications, or messages via apps for all sales and support scenarios.

Additional examples of decoupled, shareable services include:

- Client profile: managing customer data from internal and external sources, creating logical groupings where applicable.

- Product profile: keeping an up-to-date record of a client’s products and balances across systems like core banking and card processing.

- Document storage: creating a unified service for uploading and downloading user documents, signed agreements, and metadata.

These services can be reused across various applications, such as web and mobile client platforms, branch systems, and call centers, creating consistency and efficiency.

One more benefit: centralizing the development and maintenance of reusable components significantly reduces IT costs.

Improved user experience

Modern customer journeys heavily rely on seamless user experiences. The decoupled architecture enables integration with diverse content or e-commerce services to deliver a superior customer journey. APIs facilitate standardized user interfaces across all channels, ensuring a cohesive experience across different channels.

Scalability and Performance

With decoupled systems, infrastructure resources can be allocated to specific microservices, enhancing performance without requiring additional servers for the entire application. Resources can be scaled up during high-demand periods, such as seasonal peaks, and scaled back when demand decreases. This flexibility optimizes resource usage and ensures efficient operations.

Technology agnostic

Microservices in decoupled applications can be developed in any programming language, allowing development teams to choose the technology stack and framework that best fits the project’s context and their expertise. Applications are accessed via APIs, meaning consumer-facing applications remain agnostic to the underlying technology.

This approach is ideal for testing new technologies, as traffic can be incrementally routed to new systems in a controlled manner. Digital decoupling also supports a transition from vendor-based to open-source solutions, offering greater flexibility and cost savings.

Agile development teams

Decoupled applications (microservices) are perfectly suited to agile frameworks and role‑based teams. As these services mature, they can evolve into standalone products, serving as centers of technical or functional expertise within the organization. This modularity supports faster innovation cycles and more effective team collaboration.

Return on investment

Although the initial investment required to build a decoupled system can be substantial, the long-term benefits far outweigh the costs. A well-designed, scalable, and modular solution with a robust core can support multiple sites and applications for years, reducing the need for constant redevelopment.

Many of Axellect’s customers have reported rapid ROI after we helped them implement the decoupled architecture. With the right design and implementation, digital decoupling can transform IT landscapes, enabling businesses to achieve greater agility and long-term success.

The challenges of digital decoupling

While digital decoupling offers numerous benefits, it naturally introduces specific challenges that organizations must consider. These challenges primarily stem from the increased complexity of managing microservices, their interactions, and the related infrastructure. Below, we explore some of the key considerations.

Architectural complexity

Each microservice is an independent, autonomous component, and the relationships between these components must be meticulously designed to ensure seamless integration. As systems become more distributed, they introduce additional layers of complexity, such as error handling, latency issues, network dependencies, version control, etc.

To mitigate these challenges, organizations must establish clear guidelines to standardize the development and maintenance of microservices, covering areas such as:

- technology stack;

- solution architecture;

- technical architecture;

- microservice reliability patterns.

These standards help ensure consistency and compatibility across services, reducing the risk of integration issues.

Lifecycle of microservices

Each microservice operates on its own lifecycle, which means versions must be managed carefully. A robust architectural governance structure is essential to ensure that different versions of microservices remain interoperable and work cohesively as a unified system.

DevSecOps

The autonomy of each microservice necessitates a high-quality DevSecOps implementation to handle deployment, monitoring, operations, and maintenance. While decoupling enhances flexibility, it often increases costs associated with DevSecOps, as additional resources and expertise are required to manage a more complex infrastructure.

Data complexity

Decoupling applications often results in data being distributed across multiple microservices, increasing the complexity of the organization’s data architecture. To address this, organizations need to implement stringent data governance practices, ensuring transparency regarding data ownership and usage.

Dependencies

Microservices are typically developed by different teams, and their functionality often relies on inter-team collaboration. Close engagement between teams is vital, not only during the initial design phase but also when making updates or changes. Without effective communication and alignment, interoperability issues can arise.

To sum up

Digital decoupling offers a strategic solution for banks striving to modernize their IT‑landscapeand meet the rising expectations of customers in today’s digital‑first world. By isolating critical functions from legacy systems and implementing microservice‑based architectures, banks can dramatically improve time-to-market and enhance user experiences.

However, the benefits extend beyond faster innovation. Decoupled systems allow banks to scale effectively, reduce operational inefficiencies, and leverage cutting-edge technologies without disrupting existing operations. While challenges like architectural complexity and lifecycle management of microservices require thoughtful planning, the long‑term gains far outweigh the initial effort.

In essence, digital decoupling empowers banks to bridge the gap between their legacy systems and the demands of modern digital transformation.