As the financial sector undergoes one of its most significant transformations in decades, digital banking is no longer just a convenience — it’s a business imperative. Banks are not only expected to meet customers online but also to deliver experiences that are intuitive, intelligent, and integrated into everyday life.

In this article, we explore how financial institutions are reshaping their engagement models. We examine what drives their success in adapting to changing expectations, deploying essential digital tools, and building value‑added ecosystems that go far beyond traditional banking.

A fundamental shift in the daily banking model

Historically, banks primarily generated revenue from core transactional services such as interest on loans, fees for account maintenance, and commissions on various services. This traditional model was built around physical branches, face‑to‑face interactions, and well‑established, albeit rigid, processes. However, the rapid rise of digital technology and the emergence of digital‑only banks have dramatically reshaped the revenue landscape and operational structure. Let’s get into detail.

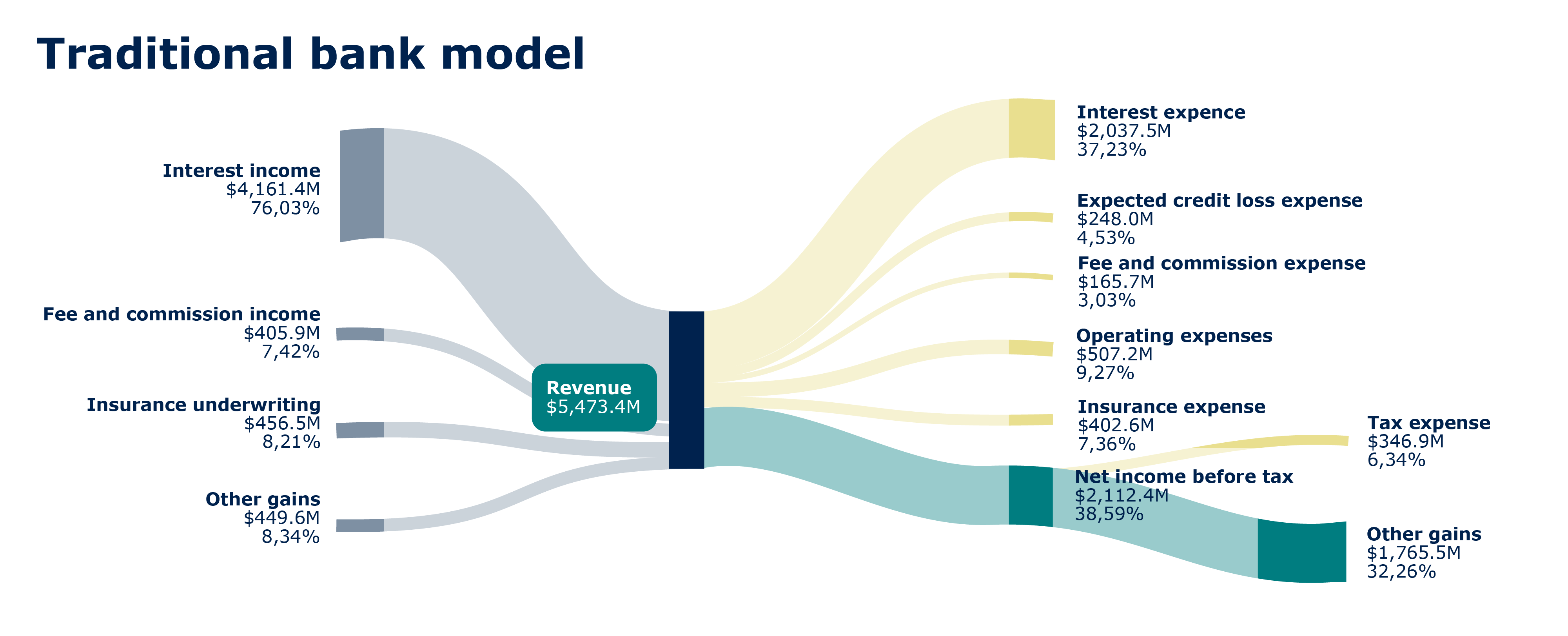

This diagram depicts the revenue and expense structure of a leading traditional bank in Central Asia. As we see, over 75% of the bank’s revenue comes from interest income, while the remaining minor part is split among service commissions, insurance, and miscellaneous financial gains (such as net foreign‑exchange gains, fair‑value adjustments on investments, or equity‑accounted earnings).

Expenses are similarly weighted toward interest payouts and operating costs, while insurance, credit‑loss provisions, fees and commissions, and taxes remain outnumbered.

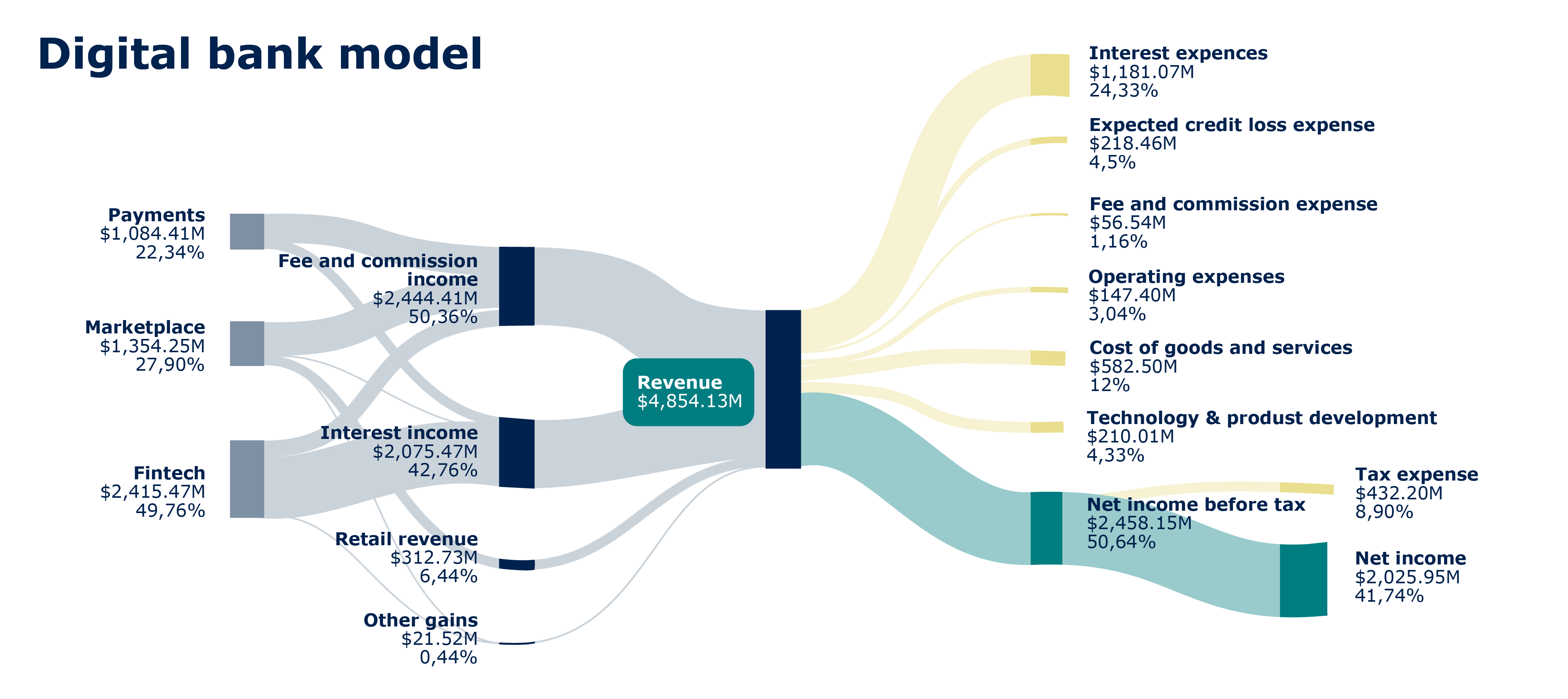

The situation is quite different in a prominent digital bank in the same region. As the diagram shows, over 50% of its income comes from fee and commission structures, notably from marketplace transactions, payment processing, and fintech services.

On the cost side, interest expense is markedly lower, reflecting the shift away from lending, and the cost of goods and services (driven by marketplace fulfillment) represents a sizeable portion of the bank’s expenses. This underscores how non‑banking services shape both the top and bottom lines.

The lesson taught

Comparing these two models highlights the dramatic shift from interest‑driven incumbents to fee‑and‑service‑focused challengers. While traditional banks rely on lending spreads for the bulk of their revenue and bear higher interest and operating costs, the digital‑only model thrives on diversified, non‑banking income streams and a leaner cost base.

This evolution is supported by changing customer behavior and the rise of digital platforms. In 2023, global mobile banking adoption reached 57% of consumers, and non‑interest income, including fees, commissions, and subscriptions, accounted for approximately 35% of total banking revenues in mature markets such as the US.

Banks now tap into these new income sources through such services as:

- Subscription models: Offering premium digital accounts with tiered benefits and monthly or annual fees. For instance, Revolut’s paid plans generated $303 million in 2024, demonstrating the strong demand for enhanced digital services.

- Value‑added services: Embedding tools like personalized financial advice, robo‑advisory, insurance options, and wealth management features directly into mobile apps creates an all‑in‑one financial experience.

- Non‑banking services: Forming strategic partnerships with fintechs, retailers, and digital marketplaces to integrate lifestyle offers, such as e‑commerce, ride‑hailing, and loyalty programs, within the banking interface. For example, one major Central Asian bank earns 28.95% of its revenue from marketplace commissions, 23.19% from payment fees, and 50.62% from core fintech products, illustrating a robust non‑banking services strategy.

This transformation is not merely structural — it redefines how banks position themselves in their customers’ lives. They are moving from transactional service providers to integrated platforms that embed financial services into broader lifestyle experiences. In this new reality, revenue stems not only from interest or commissions but also from the depth of digital engagement, the relevance of personalized interactions, and the strength of ecosystem partnerships.

What banking customers want today

Digital banking services have not come out of thin air. This is how financial institutions respond to the changing needs of their customers.

Today’s banking customers expect much more than traditional services. The digital era has raised the bar high. It is no longer enough to offer a basic suite of financial services or a functional mobile app. Today’s customers want convenience, but they also want relevance, speed, and a sense that their bank understands and anticipates their needs.

Also, today’s customers are no longer loyal to a single financial institution. In the digital age, a customer might transfer funds using one bank, take out a loan from another, and place deposits with a third — all within a few taps. Switching is easy, and the bank that offers the best combination of value, usability, and innovation wins. Loyalty must now be earned continuously.

A seamless digital experience has become a benchmark in itself. Customers now expect their interactions with banks to mirror the smooth, intuitive interfaces they encounter in e‑commerce or social platforms. They want mobile apps that are not only easy to navigate but also capable of performing a wide range of tasks — from payments and budgeting to investment planning — without friction.

But convenience alone is not enough. The modern customer values personalization. They want to feel recognized, not just as account holders, but as individuals with specific financial goals, habits, and concerns. Using real‑time data and behavioral insights, banks are now expected to tailor their communications, recommend relevant products, and even offer proactive financial advice before the customer thinks to ask.

Availability is also a defining factor. The expectation of 24/7 service has become the norm, and customers increasingly rely on banks to be always on. Whether it’s via human agents or AI‑powered virtual assistants, clients want to resolve issues, move money, or get answers at any time, without delays.

There is also the customer’s desire for integration. In the age of superapps and digital ecosystems, banking is no longer confined to balance sheets and transfers. People expect their bank to serve as a gateway to a broader digital experience, combining financial services with lifestyle features, government services, and e‑commerce tools in a single, seamless platform.

How to enable meaningful customer interactions

In digital banking, meaningful interaction goes far beyond a completed transaction. It’s about creating moments that add real value, like helping customers feel understood, supported, and empowered in their financial lives. These moments may be subtle, but they are built on intentional design and the right digital capabilities.

Personalization is at the heart of this shift. By analyzing customer data (spending patterns, financial goals, lifestyle choices), banks can move from mass communication to targeted, one‑to‑one engagement. A well‑timed message suggesting a better savings plan, or a personalized alert about potential fraud, does more than deliver information. It strengthens trust and positions the bank as an active, supportive partner.

Timing also matters. Even the most insightful message can fall flat if delivered at the wrong moment. Successful digital banks are those that know when to engage. They surface relevant content precisely when it matters: during a large purchase, ahead of a due payment, or at the start of a new savings goal, turning ordinary moments into opportunities for added value.

Equally important is the tone of the interaction. Customers respond not only to what is said but also to how it’s said. A bank that communicates with empathy — acknowledging financial stress or celebrating milestones — builds emotional loyalty that outlasts any single transaction.

To support these goals, banks must rely on a modern digital foundation. The most effective tools include (but are not limited to):

- Mobile apps that function as all‑in‑one financial hubs where customers can manage their money, plan their future, and access personalized insights — all through a single interface.

- AI‑powered chatbots and assistants that extend support beyond business hours, resolving queries instantly while learning and improving with every interaction.

- Personalized dashboards that present real‑time data in ways that are not only clear but also actionable, helping users make confident financial decisions.

- Omnichannel engagement tools that unify the experience across apps, emails, and web platforms.

How superapps deepen customer engagement

As digital banking evolves, the boundaries between financial services and daily life continue to blur. One of the most transformative developments in this space is the rise of superapps — platforms that combine core banking functionality with a host of non‑banking services, creating a seamless digital environment where customers can manage their finances and everyday needs in one place.

These superapps are not standalone ecosystems. Instead, they integrate services such as transport bookings, government payments, insurance, e‑commerce, and classifieds into familiar banking interfaces — organized by clearly labeled menus like “Marketplace,” “Travel,” or “Government Services.” What results is not just convenience, but a comprehensive lifestyle platform that meets users wherever they are.

For customers, the journey is intuitive:

- They can discover by category, tapping into tools and services beyond finance, from paying fines to booking a ride or exploring deals.

- They follow a seamless flow, logging in once to complete multiple service transactions using pre‑saved credentials, with instant confirmations or loyalty perks.

- They receive contextual prompts, such as smart notifications and AI‑powered nudges, that highlight the right offer at the right time, increasing engagement and relevance.

This model is already showing success. In the UAE, for instance, Liv by Emirates NBD merges banking with lifestyle offers, ride‑hailing, and utility payments directly within its mobile app. Similarly, Kaspi Bank in Central Asia has built a superapp where marketplace and payments services generate more than half of total revenue — a strong testament to customer demand for integrated platforms.

For banks, the benefits are also clear:

- Stronger customer engagement: The more useful the app, the more often users return, increasing touchpoints and brand stickiness.

- Diversified income streams: Banks can monetize services through commissions, subscriptions, and partnerships, reducing reliance on traditional lending.

- Deeper data insights: Each interaction generates behavioral data that enables banks to refine offerings and personalize services even further.

Ultimately, superapps are not just about bundling features. They are about reimagining what a bank can be — a trusted gateway to digital life. By investing in these platforms, banks position themselves not only as financial institutions, but as experience providers capable of supporting customers well beyond the balance sheet.

How to overcome the pitfalls of digital banking transformation

While the promise of digital banking is immense, the path to delivering seamless, engaging, and value‑driven experiences is far from straightforward. Banks face complex challenges that must be addressed with clarity, flexibility, and long‑term vision. These include fundamental shifts in business models, technological constraints, and operational complexities.

Rethinking the business model

Transitioning from transactional banking to service‑led engagement is a strategic leap. Banks must prove the value of digital services — from contextual alerts to subscription‑based financial advice — so that customers choose them willingly over traditional channels. Adoption barriers such as ingrained habits, privacy concerns, or low digital literacy are real. That’s why banks need to clearly communicate their role as digital‑first partners. This involves investing in intuitive interfaces, trust‑building messaging, and user education that clearly shows how these services improve daily financial life.

Modernizing the digital backbone

Legacy systems remain a major roadblock. According to a 2023 Deloitte study, 67% of banking executives identified outdated technology as the top inhibitor of transformation, while only 30% reported having a clear modernization roadmap. To succeed in their transformation, banks must invest in modular, cloud‑ready platforms that support custom interfaces and seamless third‑party integrations. Microservices architecture and well‑governed APIs enable rapid innovation without disrupting core systems, and this is a critical capability in a fast‑moving market.

Building operational readiness

Launching digital services is not just a tech challenge; it requires an agile operating model. Banks must establish functions that assess market demand, evaluate and onboard partners, define revenue‑sharing structures, and track results. Without strong governance, nearly 40% of bank–fintech collaborations either fail to scale or deliver meaningful ROI. The right operational setup ensures that each new service is relevant, profitable, and aligned with customer expectations.

Scaling adaptive IT capabilities

Digital engagement demands rapid execution and resilience. That means banks must be able to expand IT teams quickly, manage shifting workloads, and maintain a strong feedback loop between business and technology units. Project management within IT should be strategic — not just tracking timelines, but steering transformation initiatives with KPIs aligned to customer and commercial outcomes. Proactive investment in in‑house IT capabilities, especially for banks that develop their own products, can reduce operational costs by as much as 5%.

Bottom line

Customer expectations are changing, and digital banking must keep pace and evolve. The winners in this transformation will not be those who simply digitize traditional processes but those who reimagine the banking experience from the ground up, placing engagement, personalization, and added value at the core of every interaction.

As we’ve seen, the shift from interest‑based models to service‑centric ecosystems is already underway. Customers are embracing apps that offer more than banking: they want financial guidance, real‑time support, and integrated tools that blend seamlessly into daily life. At the same time, banks are learning that meaningful engagement is not a one‑size‑fits‑all solution. It requires agility, empathy, and the ability to act on data with precision.

And this evolution is never finished. To retain relevance and keep their active user base engaged, banks must continuously deliver something new — smarter features, better personalization, more intuitive services. This demands not just a flexible IT infrastructure, but a mindset of perpetual innovation embedded at every level of the organization.

In short, the future of digital banking belongs to those who design for depth, not just reach, to those who treat engagement not as a metric, but as a mindset. By doing so, they won’t just keep up with change — they’ll lead it.