Dubai has recently set an ambitious goal of becoming one of the top five cashless cities globally by 2033. The strategy aims to boost the economy by more than $2 billion through increased digital transactions, ensuring that all businesses in Dubai accept digital payments.

This initiative is part of a broader global shift toward cashless societies, where digital payment methods are valued for their transparency, speed, and efficiency. In alignment with this global trend, central bank digital currencies (CBDCs) are emerging as a transformative financial tool. Backed by nations’ central banks and governments, CBDCs are yet another digital form of money that many countries are currently exploring.

CBDCs hold significant potential in transforming public finance, specifically budgetary resource management. In this article, we will look closer at this use case, examining technical mechanisms that ensure payment transactions and sharing some successful pilot projects.

How CBDCs make payments transparent

As a next-generation financial instrument with advanced programmability, CBDC offers features such as marking and tracing funds. These capabilities provide a new level of control, enabling real-time data collection for objective analysis of contractors and procurement processes.

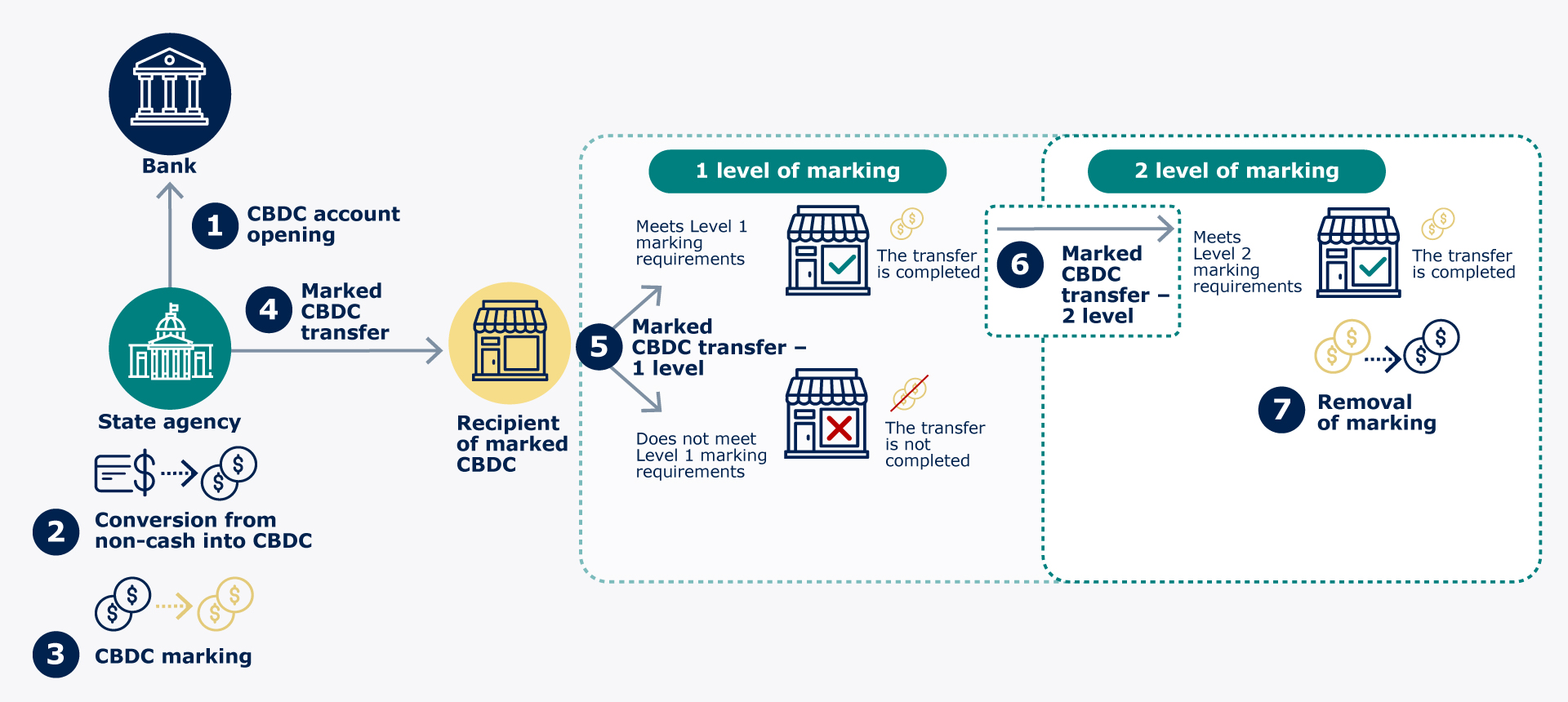

The marking process of CBDCs can be as follows:

- A bank client who is a marking initiator (a state agency, for example) opens a CBDC account and gains access to the marking function.

- The initiator converts funds from non-cash money into CBDC.

- The initiator marks the funds, specifying information such as the recipient, transfer amount, marking levels, restrictions for each level, and expiration dates. Additional parameters may include maximum spending amounts, contract numbers for tracking government contracts, and more.

- The marked funds are transferred to the recipient (contractor) with the specified restrictions.

- The recipient uses the funds according to the marking conditions.

- If there are multiple marking levels, the subsequent recipient must also comply with the marking rules.

- Once all marking conditions are met, the marking is removed, and the funds become usable for any purpose, including conversion or transfers.

Marked funds cannot be withdrawn as cash or converted into non-marked forms if the technical marking conditions prohibit it. The initiator, such as a state agency, can monitor the movement of marked funds, ensuring full transparency of transactions, including dates, participants, and amounts. Marking is lifted only when all specified conditions are fulfilled. Such an approach simplifies and accelerates the implementation of government contracts and makes them fully transparent and trackable.

However, for this mechanism to work, a predefined list of contractors for each marking level must be established. For example, in a government contract, the state agency may determine the primary contractor and create a list of approved subcontractors for subsequent levels. Subsequent recipients (subcontractors) can use the funds only in accordance with the marking conditions. For example, if the technical specifications do not allow the conversion of CBDC into cash or non-cash forms, the transaction will be impossible.

How CBDC’s token-based architecture simplifies transactions

The architecture of many CBDC projects is built on a token-based model. This means that the currency’s value is represented as digital tokens rather than being tied to individual accounts. Each token is a self-contained unit with programmable conditions, such as spending restrictions, recipient limitations, or expiration dates. This architecture provides enhanced security and flexibility, as the tokens ensure compliance with predefined rules without relying on intermediary systems.

In the context of funds marking, the token-based architecture of CBDCs offers two key advantages.

Firstly, users do not need to maintain multiple separate accounts for each type of marking, as tokens can only be spent in compliance with the conditions embedded within them.

Secondly, there is no need to use multiple accounts with different but overlapping marking conditions for a single large transaction. In a token-based model, tokens with different marks but matching conditions (e.g., for the same recipient) can be spent in a single transaction.

Where to use marked and traceable CBDCs

CBDCs are designed to overcome the limitations of traditional payment systems, promote financial inclusion, and fortify payment infrastructure with robust, reliable channels.

The most promising applications of marked and traceable CBDCs lie in the interaction between the government, businesses, and citizens.

In various parts of the world, current government procurement mechanisms often need more transparency and efficiency. They tend to rely on lengthy, bureaucratic tender processes requiring numerous approvals. This can lead to inflated costs and misuse of budget funds by contractors and subcontractors.

Marked CBDCs address these challenges by ensuring funds can only be used for their intended purposes. For example, marking can restrict funds to specific categories of goods, services, or contractors, preventing misuse.

Additionally, marked funds can support targeted budget allocation programs, which are currently implemented using fiat money. These include support for volunteer centers, funding for extracurricular education, government support for sports and cultural organizations, etc. Such initiatives could potentially be implemented using marked CBDCs.

Traceable CBDCs can also play a significant role in tracking and controlling crucial infrastructure projects. For instance, in July 2024, Kazakhstan launched a pilot project using Digital Tenge to mark budget funds for constructing the Dostyk-Moyinty railway segment. Additionally, in September 2024, the Digital Tenge platform was used to mark VAT (Value Added Tax): when making B2B transactions in Digital Tenge, part of the transaction is marked as VAT, which ensures tax collection and speeds up the refund of overpaid VAT. Digital Tenge is currently one of the most advanced CBDCs that is being tested in pilot projects with Axellect’s participation as a technological partner.

In government-citizen interactions, traceable CBDCs could streamline social payments, such as allowances or targeted assistance, ensuring funds are used appropriately. They could also be used for in corporate programs for expenses like meals, transportation, or fuel.

The final thoughts

Nearly two-thirds of countries in the Middle East and Central Asia are exploring CBDCs to enhance their financial systems and streamline payments. While most of the countries in the region remain in the research phase, nations like Bahrain, Georgia, Kazakhstan, Saudi Arabia, and the UAE have advanced to the proof-of-concept stage and pilot programs.

CBDCs represent a significant step forward in managing public finances transparently and effectively. The benefits of marked and traceable digital currencies in the economy, particularly for ensuring the targeted use of funds and compliance with regulations during transactions, appear evident. This innovation ensures resilience in the financial system while supporting the transition to a cashless economy.

However, the success of CBDCs hinges on establishing balanced regulatory frameworks. Transparent public communication and appropriate legal boundaries will be essential to ensure acceptance and trust among market participants and society.