By the beginning of 2024, Central Bank Digital Currencies (CBDCs) have been launched in 11 countries across the Caribbean, Latin America and Africa. Many more countries, including the UAE and Saudi Arabia, are currently piloting their CBDCs or researching the opportunity to launch such currencies in the coming years.

According to the latest research, in 2024, stablecoins and CBDCs represent a global market worth approximately US$ 240 billion.

Central banks actively experiment with CBDCs to foster the development of national and international financial systems while shifting monetary transactions into more transparent and secure environments.

Adopting CBDCs creates both new challenges and perspectives for the financial industry. In this article, we explore the various aspects of digital currencies issued by central banks, focusing on the motivations, challenges, and outcomes of introducing CBDCs. We also share some case studies from the Middle East and Central Asia, including Axellect’s involvement as a technology partner in the development of the Digital Tenge project.

What is CBDC?

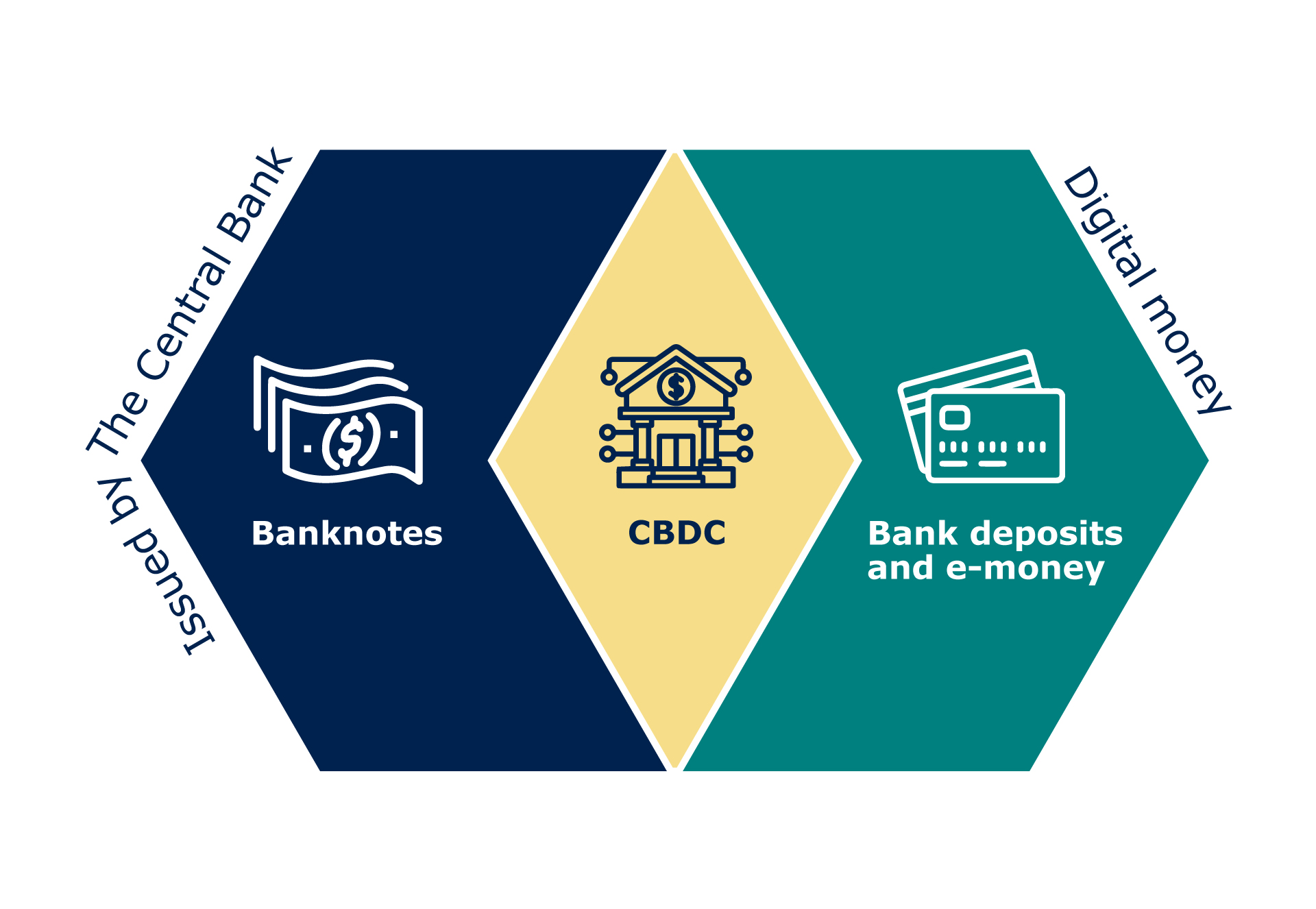

A Central Bank Digital Currency (CBDC) is a digital form of money that is issued and regulated by a country’s central bank. It represents a virtual form of fiat currency, such as dollars, euros or yen, and exists alongside traditional paper money and coins.

Key characteristics of CBDCs:

- Government-backed. Unlike cryptocurrencies, such as Bitcoin or Ethereum, which operate independently of any central authority, CBDCs are issued and regulated by a nation’s central bank. This backing by a central authority ensures stability and confidence in the currency.

- Legal tender. As legislation develops, CBDCs tend to become official currencies. This means that they can be used in all financial transactions where the country’s fiat currency is accepted, including paying taxes, purchasing goods and services and fulfilling other financial obligations.

- Digital form. CBDCs exist solely in a digital or electronic form. There is no physical equivalent (like banknotes or coins) of a CBDC, which differentiates it from traditional forms of currency.

- Interoperable. Ideally, CBDCs are designed to be interoperable with other digital financial platforms and services, making transactions seamless across different financial environments.

The implications of introducing CBDCs

The motivation for the development and implementation of CBDCs varies by country. Typically, central banks base their implementation decisions on a range of factors. These include the increasing influence of non-bank payment platforms like Alipay and WeChat Pay, the recognition of challenges from private cryptocurrency projects that could significantly impact national monetary sovereignty, and even plans by neighboring countries to issue their own CBDCs.

In developing countries and regions with less mature banking infrastructure, the introduction of CBDCs could be seen as a fast track to the most modern and innovative payment system. Such a system could increase the population’s access to banking services and improve business conditions.

In countries with developed payment infrastructures, the reasons for digital currency development differ. CBDCs can be used as a tool to increase competition since not only commercial banks but also non-banking organizations (for example, fintech companies) can become operators on the digital currency platform. Additionally, transactions with CBDCs may incur lower fees, which would be a significant incentive for the population and commercial enterprises to use digital currencies.

Also, one of the potential areas for the development of CBDCs is cross-border payments, which have recently seen growth and improvement involving an increasing number of countries. For example, the mBridge project is experimenting with creating a common DLT (Distributed Ledger Technology) platform for wholesale cross-border payments based on the digital currencies of several central banks (multi-CBDC), including the UAE, China, Hong Kong and Thailand. The presence of cheaper and faster cross-border payments using CBDCs could potentially become an alternative to international interbank systems, such as correspondent accounts and SWIFT.

What challenges CBDC development

As central banks around the globe enthusiastically explore the features and opportunities of CBDCs, the path to successful implementation is paved with a number of challenges and considerations that need to be carefully addressed.

Value proposition and stakeholder benefits

A successful CBDC launch depends on clearly understanding its value proposition, particularly how it offers new, value-added features compared to existing financial instruments. It is crucial to identify and articulate the digital opportunities and advantages for key stakeholder groups.

Commercial banks’ involvement

Commercial banks are seen as key intermediaries in the distribution process of CBDCs. However, many banks remain cautious about how digital currencies may impact their traditional business models. Currently, banks are still exploring how CBDCs could potentially add value to their services while pursuing the ultimate goal of offering innovative services that enhance their business propositions and meet evolving customer needs.

Interoperability with national payment systems

For CBDCs to function effectively, they must be seamlessly integrated into the existing financial system landscape. This integration is complex, costly and time-consuming, requiring the collaboration of multiple stakeholders. Moreover, it is essential that CBDCs coexist with current payment systems while maintaining their distinct identity. Decisions must be made regarding the target infrastructure, including which systems should remain and which may need to be phased out or upgraded.

Legal and regulatory challenges

The legal and regulatory framework also presents a significant challenge. Current legislation in most jurisdictions is not arranged and needs to be adjusted for the issuance of CBDC. Additionally, cross-border transactions introduce prudential boundaries that must be addressed to ensure compliance and seamless international interoperability. Regulation for cross-border transactions is necessary at the inter-country level and at the level of international financial institutions and associations.

Conceptual design and system maturity

As some central banks reach a certain level of system maturity, they often realize that the original CBDC design requires revisions to optimize the platform’s parameters in terms of speed, security, anonymity and other critical characteristics. Redesigning the system requires additional time, expertise and resources, which may significantly increase the initial development costs.

How CBDCs benefit finance and society

Despite varying interpretations and opinions regarding the nature of digital currencies, CBDCs are not just a new form of money but a tool that has the potential to address a range of challenges facing countries and regions.

Firstly, government-backed digital currency offers stability and reliability that are independent of the “health” of specific commercial banks. Furthermore, transaction fees may be lower than in alternative payment systems, as the central bank sets them with the goal of serving the public interest rather than maximizing profit.

Secondly, CBDCs are built on modern technological platforms, which helps reduce their operational costs. The integration of advanced features, such as smart contracts and programmable money, as well as flexible configuration options, opens new possibilities for automating and simplifying many processes.

Thirdly, in areas with underdeveloped banking infrastructure, CBDCs can become a key payment instrument. The shift in preferences among younger generations towards greater use of digital methods, which they perceive as more convenient than cash, is another significant factor.

Also, the potential for marking and tracking transactions allows for high transparency in government spending, reducing opportunities for misuse and corruption.

The overview of CBDC in the Middle East

Analysts believe that the Middle East and Northern Africa (MENA) is exploring CBDC as a means to drive innovation in payments, reduce the high costs of payment transactions for merchants (in MENA, they are among the highest in the world), make cross-border payments more affordable, and increase the transparency and traceability of payments.

At the moment, many regulators across the Middle East are focused on CBDC, with active pilots in the UAE, Qatar, Saudi Arabia, Israel and Egypt.

Project Aber was one of the first and most significant initiatives in the regional CBDC, endeavoured by the Saudi Central Bank (SAMA) and the Central Bank of the United Arab Emirates (CBUAE). The aim of the project was to evaluate the viability of a dual-issuance digital currency for domestic and cross-border transactions. The pilot for this project was launched and successfully completed in 2019 with the participation of six commercial banks, three from each country involved. The project demonstrated the technical viability of a distributed payment system based on Distributed Ledger Technology (DLT) and identified areas for future growth. It also highlighted the benefits of DLT in improving architectural resilience, performance, and privacy.

Later, the CBUAE, in collaboration with various international central banks, advanced their research through the mBridge project to facilitate cross-border CBDC-based payments. This initiative involved the participation of 20 commercial banks, which conducted experiments involving three types of transactions:

- domestic issuance and redemption,

- cross-border payments using domestic CBDCs,

- cross-border foreign exchange payment versus payment (PvP) transactions.

On January 29, 2024, the UAE successfully processed its first-ever cross-border payment using Digital Dirham, a national CBDC launched within a CBUAE Digital Currency Strategy.

Axellect at the forefront of CBDC development

Axellect, a leading provider of digital transformation solutions, is currently involved in the Digital Tenge project as a technological partner. In line with the strategy of the National Bank of the Republic of Kazakhstan, Axellect and the National Payment Corporation of Kazakhstan have developed a platform that will enable the use of digital tenge.

The project started in 2021 with the prototype development. A year later, in 2022, the digital tenge was piloted, and in 2023, it was set into field testing. In 2024, the project will be scaled, as new participants and services will be involved and a holistic ecosystem will be established. The full implementation of the digital tenge into production mode is expected by the end of 2025.

The future of CBDC

The development of CBDCs is gaining momentum. Although 70.5% of active CBDC projects are still in the early research stages, their impact on the financial industry can already be described as progressive. Digital currencies will provide new opportunities for financial market participants, stimulating the development of innovative services and products. For citizens, the new digital payment instrument will become a stable form of payment backed by the central bank’s assets, and for businesses, it will be a reliable tool with reduced fees.

The journey toward mature CBDC projects requires time and collaboration among central banks, financial institutions and technology partners. It necessitates a commitment to integrating these digital currencies into the global financial system, selecting optimal design parameters for security and usability, and creating a supportive infrastructure and ecosystem that encompasses technology, legal frameworks, and business strategies. By realising this effort, we can achieve a synergistic effect where CBDCs can enhance financial operations, promote inclusion and ensure transaction security.